If i pay 200 extra on my mortgage

If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and reduce the interest paid by more than 44000. For example if you have a 200000 mortgage with a 30-year loan term and a fixed interest rate of 39 and you pay an extra 200 per month you will not only save 43000 in.

Should You Make Extra Mortgage Payments Compare Pros Cons

If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and reduce the interest paid by more than 44000.

. Or you can do so at more frequent intervals. But even if you. Another way to pay.

What happens if I pay an extra 200 a month on my mortgage. You can make additional payments applied to your principal at the time your mortgage payment is normally due or earlier. If youre able to make 200 in extra principal payments each month you could shorten your mortgage term by eight years and save over 43000 in interest.

If you pay your mortgage every two weeks in half payments instead of once a month you will pay off your 30 year loan in 23 years and save 100000 dollars in interest that YOU get to keep. If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and reduce the interest paid by more than 44000. Sometimes its good to make extra mortgage payments but not.

For say i suppose to make 1300 for my mortgage payment interest principle. If I make extra payment for say 1500 per month will that. Because 30 year mortgages are mostly interest.

30 years fixed mortgage rate. Another way to pay down your loan in less. Another way to pay.

For example if you pay 1300 per month normally you may pay an extra 200 to the principal for a total payment of 1500. Or if you get a bit of money say a 5000 tax refund. If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and reduce the interest paid.

On my 116000 mortgage paying an extra 200 per month put me on track to cutting my mortgage duration in half. On my 116000 mortgage paying an extra 200 per month put me on track to cutting my mortgage duration in half. Repayment with extra payments per month per year one time Biweekly repayment Normal repayment Payoff in 14 years and 4 months The remaining term of the loan is 24 years and 4.

Mortgage Calculator Calculate Mortgage Payment Tables And Total Costs Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

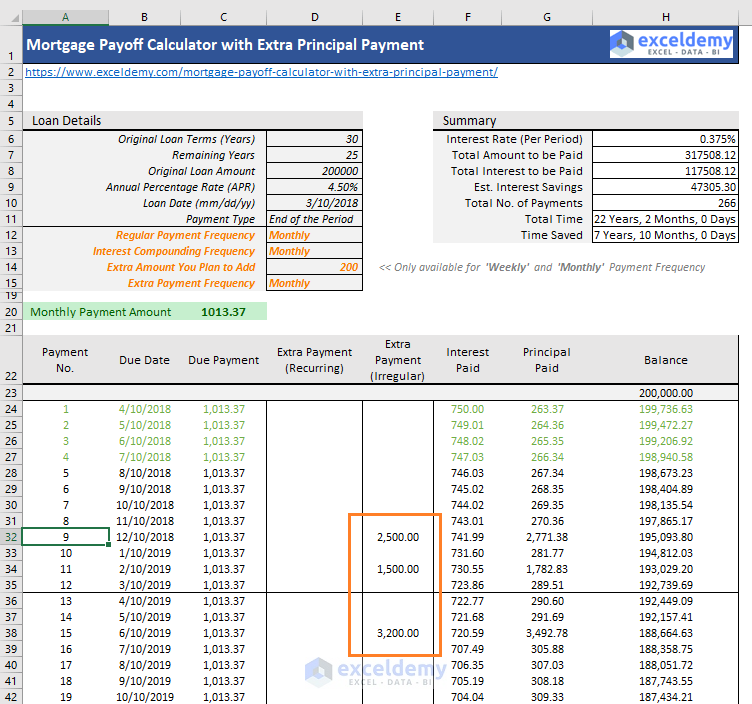

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments

Extra Payment Calculator Is It The Right Thing To Do

Do You Know Just By Paying Your Monthly Mortgage Bi Weekly You Can Save A Lot Of Time And Money When We Take And Mortgage Calculator Excel Templates Mortgage

Mortgage With Extra Payments Calculator

Mortgage Repayment Calculator

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Amortization Schedule

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

Saving 101 Archives Mintlife Blog Financial Freedom Budgeting Money Smart Money

Extra Payment Calculator Is It The Right Thing To Do

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

I M Making Extra Mortgage Payments To Achieve My Money Saving Goals

Pay Off Mortgage Early With Early Mortgage Payoff Calculator Includes Amortization Schedul Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Mortgage Payoff Calculator With Extra Principal Payment Free Template